duminică, 20 decembrie 2009

Conditii Meteo nefavorabile si Bursa

vineri, 18 decembrie 2009

eur/usd at 1.44xx today

Todays growth you can see it tehnically on M5 like a double bottom ( 1.4305@17Dec17:05,18Dec0:30 London time) or you can simply ,,gues'' if 9Dec was green after 4,7,8Dec red then 18Dec will be green after 15,16,17Dec ;

Have a nice day and good trades.

miercuri, 16 decembrie 2009

Best holidays Fx spot.

marți, 15 decembrie 2009

Termen Mediu Eur/usd

sâmbătă, 28 noiembrie 2009

www.linkedin.com un portal bussines care ajuta?!

Merita efortul tau sa vezi despre ce e vorba?! Nu stiu si eu abia m-am inregistrat dar posibil sa fie un loc de unde sa incepi sa cunosti oameni care au cat de cat putina legutra cu lumea financiara, sa cunosti si altfel de oameni cu interese de socializare business nu doar hi5 unde fiecare isi da in petec cu poze care mai de care.

sâmbătă, 17 octombrie 2009

miercuri, 14 octombrie 2009

Miercuri 14 Oct2009

marți, 13 octombrie 2009

Marti 13 Octombrie

marți, 6 octombrie 2009

vineri, 25 septembrie 2009

Vineri 25 septembrie Updated

- Vanzarile au scazut dramatic in USA.

- Dollar Gains on Riskier Rivals

Vineri 25 septembrie

joi, 10 septembrie 2009

Inversare de trend?!

marți, 8 septembrie 2009

Marti 8 septembrie

By NICHOLAS HASTINGS

LONDON -- Hopes of a global economic recovery pushed the dollar lower and the euro higher in Europe Tuesday.

The positive sentiment was also enough to help the price of gold over the $1,000 an ounce level for the first time since February.

The euro pushed ahead to $1.4440 by 0930 GMT, taking it well above $1.4339 late on Monday in Europe, according to EBS. The dollar fell to 92.26 yen from 92.97 yen. The pound rallied sharply to $1.6496 from $1.6399.

Although U.S. markets were closed for Labor Day Monday, other global markets appeared to be still taking their cue from G-20 assurance over the weekend that there is no hurry to bring an end to the extraordinarily easy monetary policy in most major economies.

Further evidence of an upturn came from Australia, where the latest National Australia Bank business confidence survey showed a rise to levels last seen in October 2003.

Germany also injected some positive sentiment, with its latest trade data showing that exports rose by another 2.3% during July, helped by increased demand from Asia.

"It looks as if exports have become a trump card," said Carsten Brzeski, senior euro-zone economist with ING Financial Market in Brussels.

Although this positive mood was enough to help the euro and the pound sharply higher against the dollar, there are some caveats.

Bank of Spain Governor and European Central Bank member Gonzales Paramo warned that the markets might be reacting too optimistically to better economic data.

"We think that these concerns are valid and will imply a considerable period of low rates, if not a further cut -- or cuts -- before the cycle is finished," said Steve Barrow, senior currency strategist with Standard Bank in London.

Concern was also being expressed about the continued rally in Chinese shares, amid speculation that the Chinese government is providing support for equities ahead of the 60th anniversary of the People's Republic of China Oct. 1.

"We wonder if upside in the stock market is actually a meaningful indicator to economic activity in China," said Sue Trinh, senior currency strategist with RBC Capital Markets in Sydney.

luni, 31 august 2009

Luni 31August2009

duminică, 23 august 2009

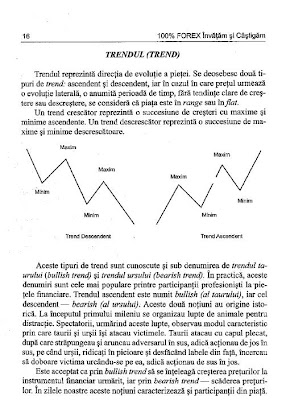

EUR/USD:Poate fi considerat un triunghi simetric?

- strapungerea se face la 1/3 de la varf

- strapungerea se incadreaza in zona 1/2 si 3/4 de la baza

- formatia are 4 puncte adica 2 maxime si 2 minime

duminică, 16 august 2009

Vineri 14 August

marți, 4 august 2009

Ce Credeti despre noile reguli pentru conturile de retail din USA?

How to use Stops & Limits after July 31

Dear Client:

Please note that you will be able to use entry orders to place stops and limits after July 31, 2009. Entry orders provide the ability to realize profits and cut losses.

USING ENTRY ORDERS FOR STOP-LOSS AND LIMITS AFTER JULY 31, 2009:

For Buy Positions: Placing an entry order to sell below the price where you got into the position protects you from additional losses. Placing an entry order to sell above the price where you got in locks in profits.

For example, if you have a BUY EUR/USD position at 1.3900, you could place:

a stop-loss using a sell entry order (Stop Entry, SE) at 1.3800

OR

a limit using a sell entry order (Limit Entry, LE) at 1.4000.

For Sell Positions: Placing an entry order to buy above the price where you got in protects you from additional losses. Placing an entry order to buy below the price where you got in locks in profits.

For example, if you have a SELL EUR/USD position at 1.3900, you could place:

a stop-loss by using a buy entry order (Stop Entry, SE) at 1.4000

OR

a limit using a buy entry order (Limit Entry, LE) at 1.3800.

"The National Futures Association (NFA), which is the Forex industry's self regulatory organization in the United States, has informed all Forex Dealer Members (FDM) that it has adopted new Compliance Rule 2-43(b) regarding Forex trading. This rule requires orders be executed on a First In, First Out (FIFO) basis. FIFO requires that when multiple positions are held in the same currency pair, the position which was first opened will be the first to be closed. This will prevent stop-loss and limit orders from being placed on individual tickets (orders and positions).The NFA's stance is that FIFO provides more transparency to customers, offering a more accurate picture of the customer's overall profit and loss (P/L) than viewing the results of individual positions. The application of this rule brings the Forex market more in line with the practices of the Futures and equities markets.

FXCM has always encouraged active risk management through the use of stop-loss and limit orders. The stop and limit orders that have been available through the Open Positions window are two entry orders that are linked to an individual open position. If a stop or limit order is triggered, the other is canceled. FXCM has introduced a new feature called OCO (One Cancels the Other) entry orders, which will provide traders with the same functionality as they have been accustomed, except that they are not linked to any positions."

As a result of the changes beginning this month, anyone with a US Forex account should check to see how their broker is going to comply with the new rules, and what changes to the current method of order entries will be made, if any. It is assumed that every Forex broker has contacted their clients to advise them as to any changes by this time. However, if you have any questions or concerns after reading this article, the trader should contact their broker directly, and ask about Compliance Rule 2-43(b).

The NFA has a website that every Forex trader should visit for more information about their broker. Any Forex broker that is an NFA member has to meet high standards including a large minimum capital requirement to do business. "